Improve Mileage Recording with a Mileage Tracker App and a Simple Mileage Log

Improve Mileage Recording with a Mileage Tracker App and a Simple Mileage Log

Blog Article

Optimize Your Tax Reductions With a Simple and Efficient Mileage Tracker

In the realm of tax reductions, tracking your gas mileage can be an often-overlooked yet essential job for optimizing your economic advantages. A properly maintained mileage log not only makes certain compliance with internal revenue service demands yet also boosts your capacity to confirm company costs. Choosing the ideal gas mileage monitoring tool is essential, as it can simplify the process and improve accuracy. Nevertheless, several individuals fail to fully leverage this opportunity, bring about potential shed savings. Comprehending the subtleties of reliable gas mileage monitoring might reveal techniques that might considerably affect your tax obligation scenario.

Relevance of Gas Mileage Monitoring

Tracking mileage is vital for anyone seeking to optimize their tax reductions. Precise mileage tracking not only ensures conformity with IRS regulations yet additionally allows taxpayers to profit from deductions associated with business-related travel. For freelance individuals and entrepreneur, these reductions can substantially minimize taxed income, consequently lowering overall tax responsibility.

Moreover, keeping an in-depth record of gas mileage helps identify between personal and business-related trips, which is crucial for confirming insurance claims during tax audits. The IRS needs certain documents, including the day, location, function, and miles driven for each journey. Without precise documents, taxpayers run the risk of losing important deductions or facing penalties.

Furthermore, effective mileage monitoring can highlight trends in traveling expenditures, aiding in much better monetary preparation. By evaluating these patterns, people and organizations can determine opportunities to enhance travel courses, minimize expenses, and boost operational efficiency.

Picking the Right Gas Mileage Tracker

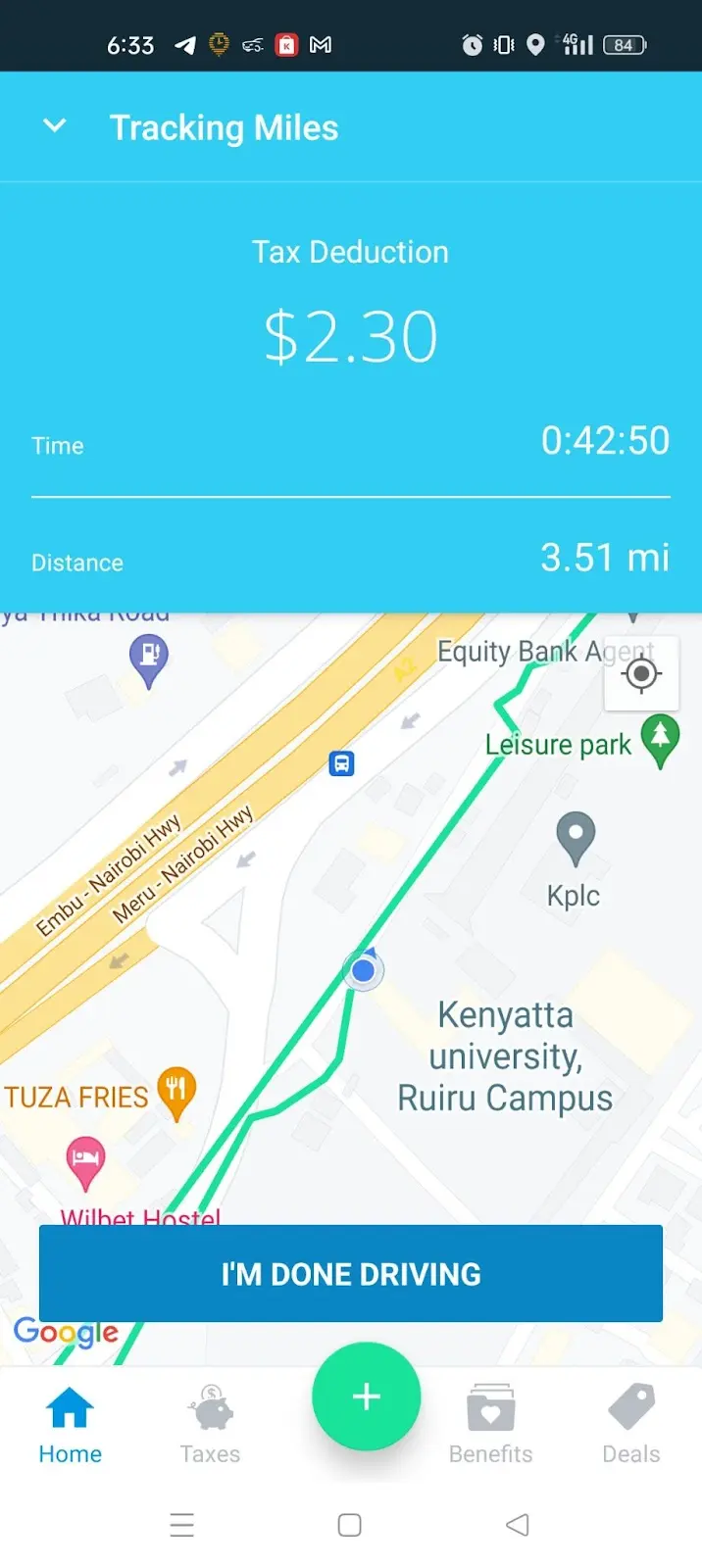

When choosing a mileage tracker, it is vital to consider various attributes and functionalities that align with your certain needs (best mileage tracker app). The very first facet to assess is the approach of tracking-- whether you prefer a mobile application, a general practitioner device, or a manual log. Mobile apps commonly supply ease and real-time monitoring, while GPS tools can supply more precision in distance dimensions

Next, evaluate the integration abilities of the tracker. A great gas mileage tracker must seamlessly integrate with accounting software program or tax obligation preparation devices, enabling for uncomplicated data transfer and coverage. Look for attributes such as automated tracking, which reduces the need for hand-operated access, and categorization choices to compare organization and individual journeys.

Just How to Track Your Mileage

Picking an appropriate mileage tracker sets the foundation for reliable mileage monitoring. To precisely track your mileage, start by figuring out the purpose of your trips, whether they are for service, philanthropic tasks, or medical reasons. This clearness will certainly help you classify your trips and ensure blog you catch all pertinent information.

Next, regularly log your mileage. For manual access, record the beginning and finishing odometer analyses, along with the date, function, and course of each trip.

It's likewise vital to routinely assess your entries for accuracy and completeness. Set a routine, such as weekly or month-to-month, to consolidate your records. This method assists avoid discrepancies and guarantees you do not ignore any type of insurance deductible gas mileage.

Lastly, back up your records. Whether electronic or paper-based, keeping back-ups protects against information loss and facilitates the original source simple access during tax preparation. By faithfully tracking your gas mileage and keeping arranged records, you will certainly prepare for maximizing your prospective tax obligation reductions.

Optimizing Deductions With Accurate Records

Accurate record-keeping is important for optimizing your tax obligation deductions related to mileage. When you preserve comprehensive and exact records of your business-related driving, you create a robust foundation for asserting deductions that might substantially decrease your taxable revenue.

Using a gas mileage tracker can enhance this process, permitting you to log your trips effortlessly. Numerous apps immediately compute distances and classify journeys, saving you time and reducing mistakes. In addition, maintaining sustaining documents, such as receipts for related expenses, strengthens your situation for deductions.

It's important to be consistent in videotaping your mileage. Daily tracking ensures that no journeys are ignored, which can cause missed out on reductions. Regularly evaluating your logs can aid identify patterns in your driving, permitting better preparation and potential tax cost savings. Eventually, exact and well organized gas mileage documents are essential to maximizing your deductions, guaranteeing you make the most of the possible tax obligation advantages readily available to you as an organization chauffeur.

Typical Mistakes to Stay Clear Of

Preserving careful records is a significant action towards maximizing mileage deductions, yet it's similarly crucial to be familiar with usual errors that can threaten these efforts. One widespread error is stopping working to record all trips accurately. Also minor business-related journeys can add up, so overlooking to videotape them can bring about substantial shed anchor deductions.

An additional mistake is not separating in between personal and business mileage. Clear classification is vital; blending these two can trigger audits and bring about fines. Additionally, some individuals fail to remember to keep sustaining documents, such as receipts for related expenses, which can further verify claims.

Inconsistent monitoring techniques also posture a challenge. Relying on memory or occasional log access can lead to inaccuracies. Utilizing a mileage tracker app makes certain regular and reputable documents (best mileage tracker app). Finally, neglecting IRS guidelines can threaten your claims. Familiarize on your own with the most up to date policies regarding gas mileage reductions to avoid unintentional mistakes.

Final Thought

In conclusion, efficient gas mileage tracking is crucial for optimizing tax deductions. Utilizing a reputable gas mileage tracker streamlines the process of tape-recording business-related journeys, ensuring exact documentation. Routine evaluations and back-ups of gas mileage documents boost compliance with IRS policies while sustaining informed financial decision-making. By staying clear of common pitfalls and keeping careful documents, taxpayers can considerably decrease their overall tax obligation liability, ultimately profiting their monetary health. Carrying out these practices cultivates a positive approach to managing business costs.

Report this page